May Real Estate Market Update - Greater Sacramento - California - National Trends

This is a comprehensive breakdown both in video form at the top and charts/ graphs below. In both I work to give a breakdown of the data and my opinion on some occasions. This is your Sacramento Real Estate market in May 2024 with a look at Placer, El Dorado, and California stats as well as a national perspective on prices and interest rates.

Quick Market Update:

The market feels cooler than it did a month ago. The market isn’t scorching hot, but there are still groups of 10-20 home buyers at most open houses. I’m still showing various families multiple homes and I have multiple listings. Buyers are taking longer to make buying decisions and rightfully so since their payments are so substantial without a large down payment. Most sellers are selling because of big life changes or to use the equity to keep the payment on their next house low. Sac median price remained the same from March to April, though interest rates

Sellers:

Now is the time to get your home on the market if you’re thinking of selling in 2024. The Sacramento Market peaks out in May / June each year and then prices begin to drop until the bottom out in Jan / Feb of the following year.

Buyers:

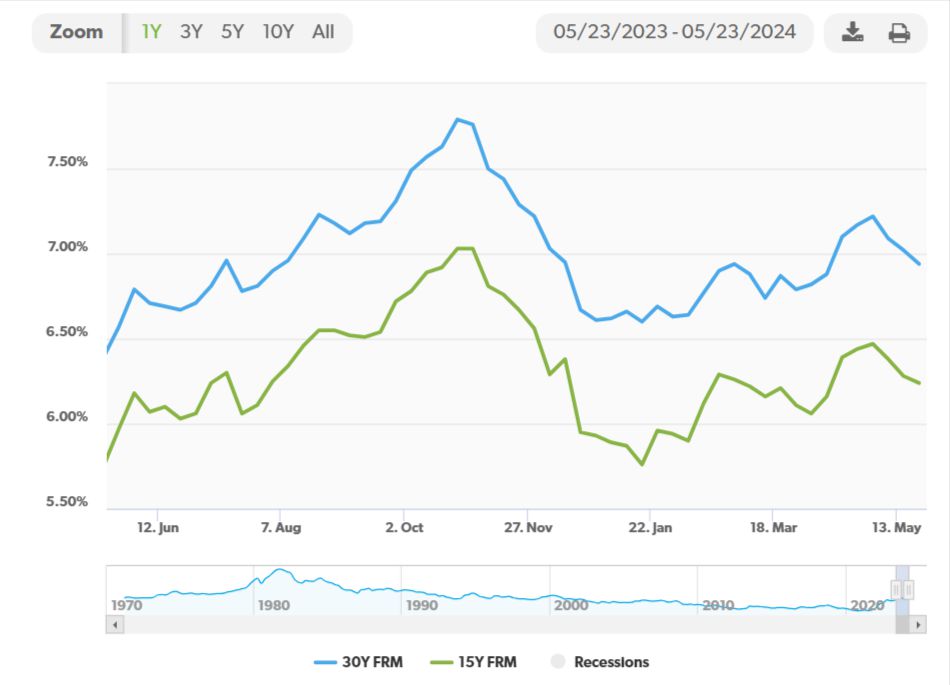

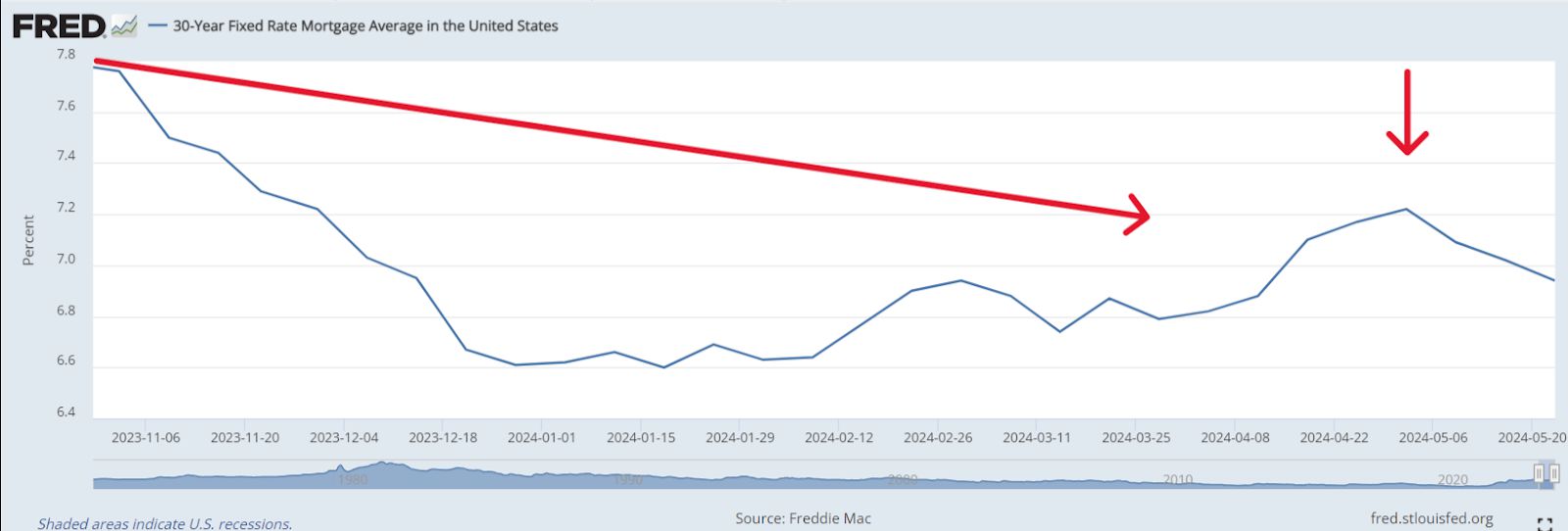

There is a new down payment assistance program that gives $15,000 toward buyers down payment for first time home buyers* and the rate only increases by 1/8th of a percent, which is NOTHING compared to past programs. We are going to see the prices grow steadily in the coming month and peaking out around July. Interest rates appear to have hit a plateau hovering around 7% down from 7.5%, this year's high. Though not moving much from this range in the last few weeks. If they change significantly in either direction, this will skew the market.

*First Time Home buyer for this program is someone who has not purchased a home in 3 years. They CAN own a home. They may have purchased homes in the past.

Interest Rates

Interest rates provided here are only provided as a national average, and can vary from person to person, and lender to lender. I can help you find a lender with exceptional service who does not charge points or fees when you’re ready. A no fee, low interest rate lender, will keep your costs down, improve your experience, and help you to qualify for more houses with a smaller payment. They can beat other lenders because of how compensation for lenders is calculated. Smaller companies have less overhead, thus are able to outcompete larger companies.

By my calculation

7.42% - Historical Median Interest Rate from 1971 - 2023

In RED below, you will see rates are trending downward and are now on average below 7%, in our last report we were above 7% are trending upward.. This is great for buyers and sellers alike, BUT will increase competition on an already limited number of available homes if the trend continues.

Detailed Sacramento Market as of the last published report:

Sacramento County (including City of West Sacramento):

Median Price Month / Month- 0% Change vs April which was up 2.8% (Slowing growth)

Median Price Year / Year - Is up 5.05%, April was up 9.9%, (5% is healthy and sustainable)

Housing Inventory - Inventory is keeping pace with demand, 0% change from last month.

Monthly Median Price Sold - as of the end of April 2024 is $550,000, 0% change from March.

Current Median Price Approx. - As of 5/12/24 $555,000, .9% Increase Mnth/Mnth

My Take on the Sacramento Market: Median price appears to have plateaued for the year, lower than the all-time high price of $575,000 set in May of 2022. 2022 was also notably before interest rates continued to drastically increase. However, if rates continue to drop, there’s a chance the median price can continue to rise later into the season. Additionally, there are some new down payment assistance options available. For example the most publicized program, “Dream for All,” which is actually the dream for very very few program in practice, has the potential to increase prices in the short term once it’s released, it’s release date is a mystery, however, what we do know is that it’s participants will be picked by lottery only from applicants, its only available to first generation homeowners, it cover 20% down payment, and once the lottery is picked each buyer only has 90 days to find a property or they lose their eligibility. The last program which was far more inclusive caused a noticeable price surge, it's likely we’ll see a short spike from this program launch as well. The reason they cause a surge is because with limited funds, participants are incentivised to get an offer accepted right away before funds are depleted, the last program last 11 days before it ran out of funding, I was happy to have a client who benefitted from the program who otherwise would not have been able to afford a home.

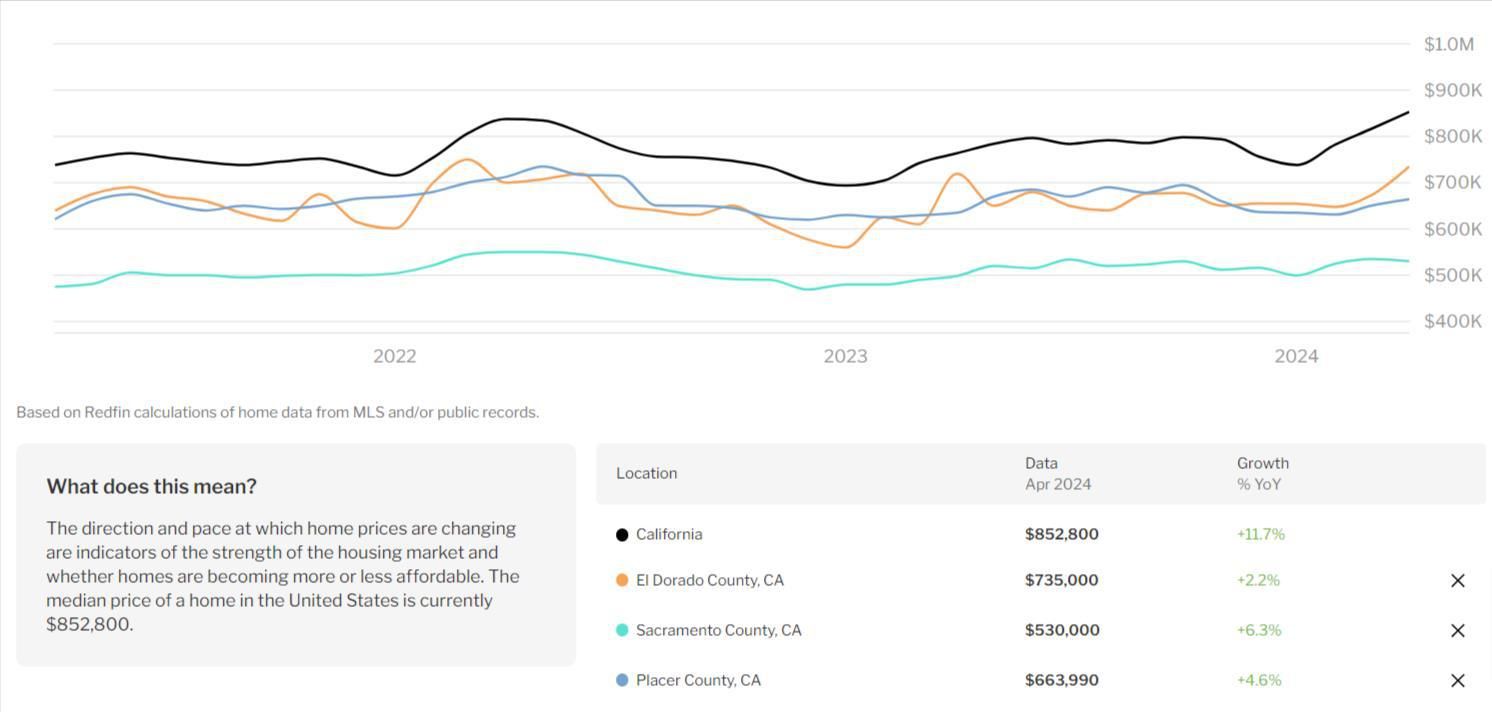

California Market:

Redfin data shows Year over year Growth of:

California - 11.7%

Sacramento County Only (not including City of West Sac) - 6.3%

Placer County - 4.6%

El Dorado County - 2.2%

Note: County Data is vast with numerous rural areas. If you want specific data on your Zip Code please let me know and we can discuss your specific needs.

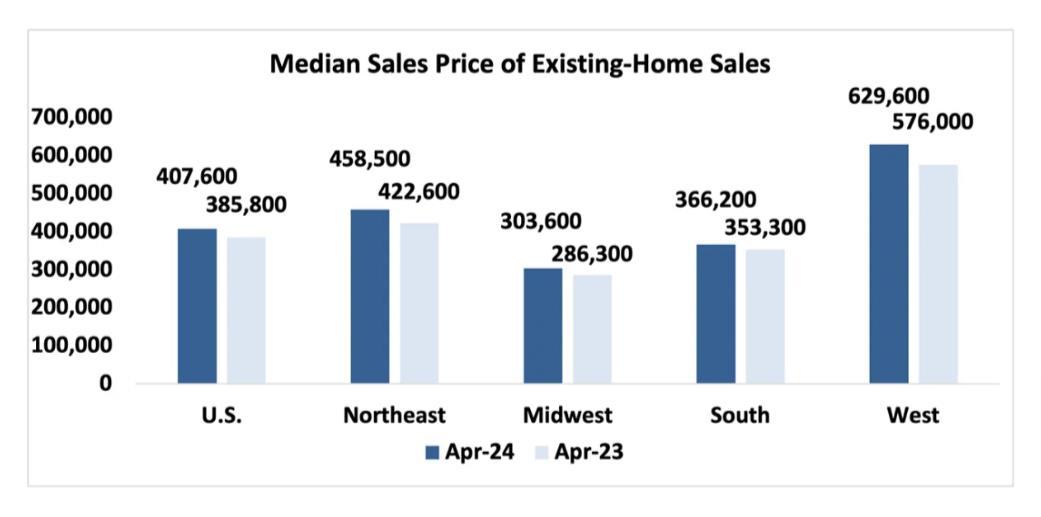

Nationwide:

We are seeing growth across all regions year over year nationwide, albeit, slower than CA and slightly up at 5.7% from last month's 4.8%. This is still steady growth nationally and is evidence of a healthy market. I would expect to see growth peak in mid to late summer and begin a decrease through winter nationwide, which is cyclical and normal.

Sources:

https://www.nar.realtor/blogs/economists-outlook/latest-existing-home-sales-data-graphs

https://www.redfin.com/state/California/housing-market

https://sacrealtor.org/housing-statistics/

https://fred.stlouisfed.org/series/MORTGAGE30US

https://www.car.org/marketdata/data/ftbhai/

https://www.freddiemac.com/pmms

Check out More Home Buyer information

Check out more Home Seller information

Categories

Recent Posts

GET MORE INFORMATION

REALTOR® | Lic# 01880915